Will I be charged tax on my purchases of FlippingBook products and services?

The prices for FlippingBook products and services that you can see on our website are shown without taxes which may apply to the sale of digital goods in your country.

Our products are sold by our e-commerce partner Cleverbridge GmbH, registered in Germany and as Cleverbridge Inc. in the US. Depending on your location, Cleverbridge GmbH will add applicable taxes to your purchases in accordance with local legislation. If your purchased items are taxable, you will see the amount of tax applied during the checkout process and also on your invoices.

In this article, you can find tax-related information for the following countries and regions:

Note! We at FlippingBook are no experts on tax. We are a software development company and our expertise is in developing and maintaining software. Our e-commerce partner Cleverbridge GmbH takes care of all the tax-related matters for us. In this article, we aim to provide you with tax-related information to the best of our knowledge. However, to get the most accurate and reliable information about taxes, it is always best to contact Cleverbridge directly.

The European Union

The European Union collects value-added tax (VAT) on digital goods based on the residence of the customer.

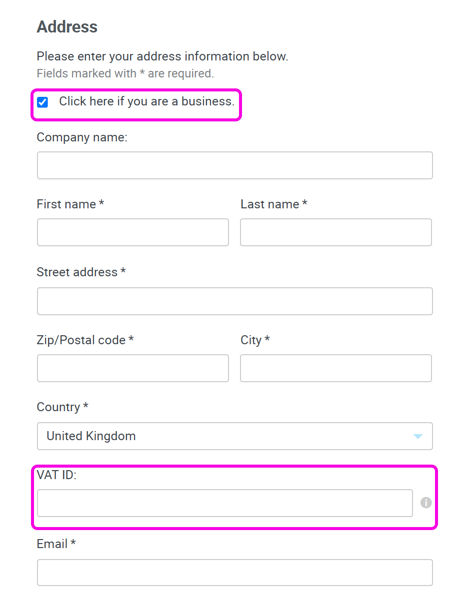

Except for customers located in Germany, European Union companies with a valid VAT ID do not have to pay VAT during the checkout process under the reverse charge mechanism. Instead, you pay VAT in your own country. You can enter your VAT ID during the checkout as shown in the screenshot below:

The United States

In the United States, some states collect sales tax on digital goods and others don't.

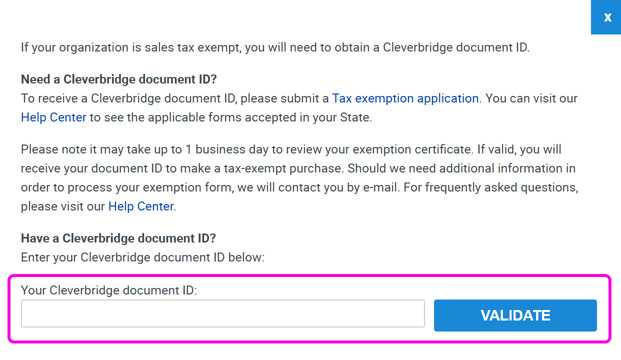

Tax-exempt organizations can avoid paying sales tax by registering with Cleverbrige and obtaining a Cleverbridge Document ID. To register with Cleverbridge as a sales-exempt organization, you will have to send an exemption certificate to Cleverbridge at payments-us@cleverbridge.com. For more information, please, see Cleverbridge’s instructions on how to obtain a Document ID and place an order without being charged sales tax.

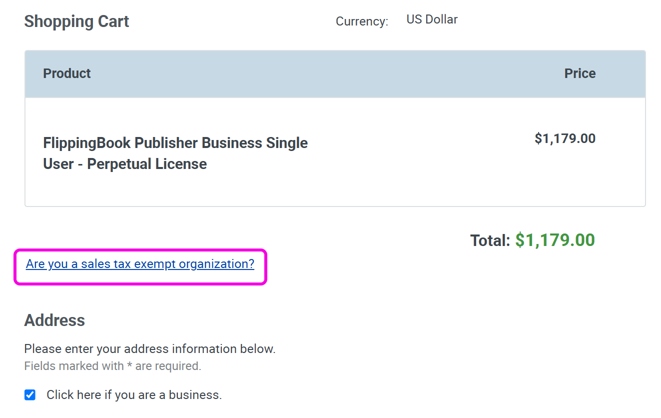

If you have your Cleverbridge Document ID, you will be able to enter it during the checkout process by clicking on the link 'Are you a sales tax-exempt organization?' as shown in the screenshot below:

And then you can enter your Document ID:

If your company has already registered in the past with Cleverbridge and obtained a Document ID, but you lost or forgot it, contact us and we will look it up for you.

India

Starting from July 1st, 2017, India collects Goods and Services Tax (GST) on electronic services delivered to Indian consumers by suppliers outside of India.

As it is currently not possible to automatically check any GST or other relevant tax numbers of Indian companies and verify their status, Cleverbridge charges GST to all customers to comply with the law. However, if you are a business customer, you can get GST refunded from the purchase if you contact Cleverbridge and provide the following information:

- a valid GST number

- a certificate of residence or a current service tax registration form. The document has to be written in English.

Turkey

Turkey collects value-added tax (VAT) on digital goods. As it is currently not possible to automatically check VAT ID numbers for Turkish companies and verify their status, Cleverbridge charges VAT to all customers to comply with the law.

If you are a business customer and have a valid VAT ID number, you can get the VAT amount refunded from your purchase if you contact Cleverbridge.

Australia

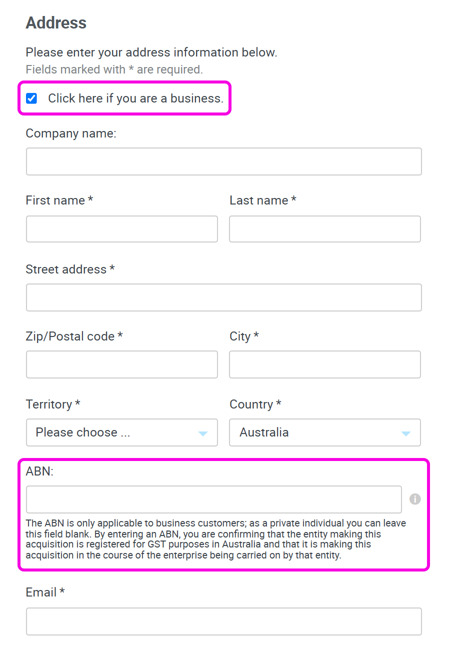

Customers in Australia are charged Goods and Services Tax (GST) unless they provide a valid Australian Business Number (ABN).

If you are a business customer and have a valid ABN, you can enter your ABN during the checkout as shown in the screenshot below:

The Republic of South Africa

Starting from May 1st, 2019, the Republic of South Africa collects value-added tax (VAT) on all electronic services rendered to South African customers.

Cleverbridge is registered in South Africa for VAT purposes with the following TRN: 4340286030.

Please note that as a non-resident VAT-registered entity, Cleverbridge is not allowed to refund the VAT amount that was charged. But if you are a business customer, you can get a VAT refund when you file for the taxes in South Africa. Cleverbridge can add your company VAT number on the invoice upon your request.

Contacting Cleverbridge Customer Service

If you haven’t found the answer to your question in this article, please contact Cleverbridge directly.